Val Workman

The opinions expressed by the bloggers below and those providing comments are theirs alone, and do not necessarily reflect the opinions of Ryma Technology Solutions. As they say, you can't innovate without breaking a few eggs...

Stage 0: Opportunity Identification and Idea Generation (Part 2)

I'm putting this innovation lifecycle back up to provide context of what I'm addressing. I'm still focusing on Stage 0. In part 1, I talked about idea generation and handling, in this part I'll be talking about opportunity identification, and then part 3 will focus on opportunity analysis.

Opportunity Identification: There are people out there who wouldn't know an opportunity if it hit them in the back of the head. Well, in truth most of us are a little like this. As in so many things, part of the problem here is poor communication, specifically the over use of the word "opportunity". It could mean all sorts of things, especially in the context of product management.

To help clarify things, we need to understand the concept of an opportunity lifecycle. Folks don't find it too hard to believe that opportunities expire. In other words, at some point in time, maybe a very long time, but still at some point opportunities expire. Likewise, opportunities have a starting point. Where we need a discussion is around what is between the beginning and end.

The Opportunity lifecycle is much like the lifecycle of a butterfly. That's not true, the papilionoidea is the superfamily of all true butterflies. These creatures have two major stages in life: one is that of a butterfly and the other is that of a caterpillar. The opportunity is like this: with one stage as a business opportunity, and the other as a market opportunity. Each of these seemingly different types of opportunities are actually the stages of one lifecycle.

On a continuum, the opportunity lifecycle may look like this, however the exact point on the continuum where a market opportunity becomes a business opportunity is a little fuzzy.

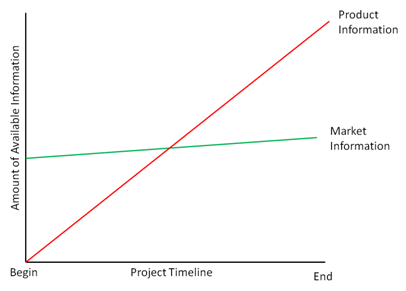

In each moment of the opportunity lifecycle, the opportunity looks different, but between the two major phases the opportunity looks very different. It looks just as different as a caterpillar and its butterfly. To understand this difference we need to recall a little about what the opportunity eats. Opportunities eat information. The more information that's available, the more defined the opportunity becomes. In the beginning of a project, information about the market is plentiful, but information about the product is scarce.

When talking about opportunities, the old adage about "you are what you eat" holds true. The opportunity begins to look much like a market opportunity in the beginning because that's the type of information available. The opportunity slowly begins a transformation as more product information is available to eat.

The relationship between product information and business opportunity may not be instantly apparent. Sometimes market information is referred to as external information which makes sense. Normally external information is paired with the concept of internal information. Internal information captures your ability to capitalize on market opportunities. This includes such things as existing assets and skill sets that can be leveraged, investment capital, and availability of resources. But after careful consideration, you'll conclude that this information is mostly dependent on your product concept and not the market problem.

When the solution to a market problem begins to form, internal information can be gathered relevant to that particular product solution. When feeding upon this internal information, the business opportunity begins to form. The queen bee is like this in that she becomes a queen bee only when she's continuously fed royal jelly. As an example of this relationship, if my new product concept was a solar-powered watch, I would need a different set of skills, than I would if it was battery powered, or nuclear. Each of these solutions would present a very different business opportunity, yet the market opportunity wouldn't change. Well, maybe in the extreme cases, but hopefully you get the point. The business opportunity doesn't form until product concepts begin to generate new product information. Then and only then can business information be collected to identify a business opportunity.

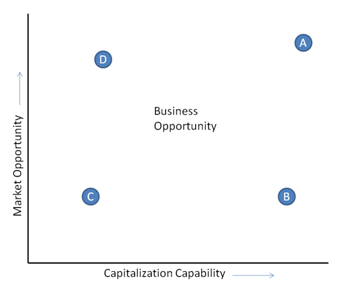

This leads to a two-step approach to opportunity identification (I like to call it the Texas Two-Step). First we identify the market opportunity. This is an aggregation of various criteria used to assess market opportunity, and becomes the "Y" value in a XY chart. The next step is to indentify business opportunities when internal information relevant to a specific product approach can be created. At that time, values are aggregated and the X values on the XY chart form. The business opportunity isn't the X value, that's an aggregation of internal information. A business opportunity is the combination of the X and Y values on the XY chart.

The importance of understanding the opportunity transformation is this: you can evaluate market opportunities much sooner in the innovation lifecycle than business opportunities.

Business opportunities "C" and "B" in the XY chart above illustrate this point. Once the market opportunity is defined, the Y dimension doesn't change that much as the product concept develops.

Yes, "C" may move to the right, and become a "B" business opportunity, but product management has to make changes to "C" and increase its market attractiveness and push it up to "D" before worrying about the product concepts.

The earlier in the process, the less expensive change is. If I'm talking about market opportunity, I should be looking at market evidence, problem statements, and segmentation. This is all about identifying the importance of the problem being addressed to a particular targeted segment. To move "C" to "D" you need to increase the scope of the problem by combining two or three other problem statements or expand into market segments where addressing the problem will have greater market impact.

Once the market opportunity has been maximized, your team moves the opportunity to the right towards the "A" position to maximize the business opportunity. Sometimes opportunities can't be moved away from the "B" position, you have to invest in this for sustainability. Other times you're forced to act on a "D" opportunity through acquisition of new capabilities.

So we now know how to identify an opportunity, the question remains, how did you get the value of your capitalization capability and your market opportunity? Opportunity Analysis will be presented in Part 3 of this series.

Even if you hate shopping, you'll find at least one gem to buy in Hong Kong. With spending embedded in the culture and consumerism deep in this manufacturing hub's roots, this island isn't known as a shopping mecca for nothing.